Good afternoon,

I want to reflect and predict about some markets in

general.

Some ten years ago or so, the USA was experiencing a situation similar to the Japanese, bad real estate loans, banks and saving inst. Failing.. Sound familiar?.At that time the voice of the international community, primarily the Japanese were making the same statements to the US Gov't that the US Gov't is making to the Japanese now.

Well, we came out of the rough so to speak and my prediction is that Asia and Japan will do the same....What to do? If you have been a big bull of US dollars and stocks.. You better watch out.. For the change will come and when it does you do not get it in its way.

Is this an out look for tomorrow or next week?. Probably not, next month next year most likely.

As traders we should be 'looking into the future with an imagination...perceiving what might happen and taking action "

This was a lesson taught to me by a friend Bob Rowland..

now retired from the business but in his life (as told to me)traded over

10 million silver contracts and experienced the heydays of the beans in

the 60's 70's and the bellies from day one.

Bob used to hang out and trade with some of the great

ones years ago.. and it was my privilege to learn all I could from the

couple of years we worked together.

Computer trading programs can never replicate the knowledge of experience.These days most of the systems and programs are like looking at a microscope view of the markets ..geared to the info age of real time and minute by minute news.

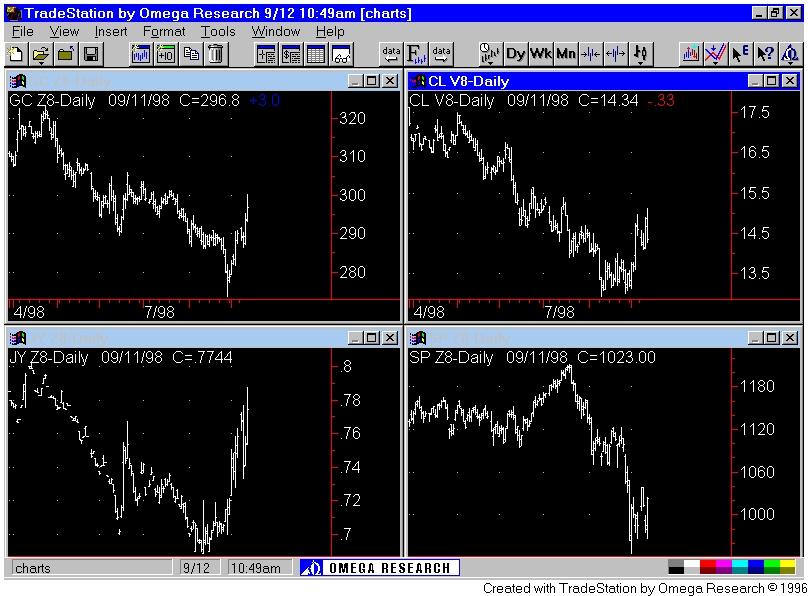

Take my advice and take a step back some time and look beyond the Noise to see what's really happening ...For instance , take a look a the Nikkei, it is still marginally near or above last years end of year price region., while the US Small caps are below last years end of year prices and the Big stocks are getting dangerously close to the last years end of year prices.

Now think for a minute. We are the strong ones and they are the weak. But has it really changed this year ? Not much.. My belief is that over the next few years the Japanese and Asia will gain on the US...as the US gained on the Japanese over the last ten years. If you think the Asians are going to lay down and die and only then recover by doing what the US tells them to, you are in my opinion very wrong. In fact I believe their improvement will become our loss down the road....just as our improvement was their loss over the last ten years.

What should traders do ?

First analyze the big pictures

For example the recent events that occupy the 'talking heads'. The Japanese weakness , the Russian problems are a result of things that have been building for a long time .In my opinion ..the climax is taking place as we speak. how long will it last it ? I don't know , but my opinion is that we are nearing the end ..So as A Traders I have no interest in Selling Japan. Period.

What's the next thing ? Worry every minute but be patient. Or Stay tuned each day to FuturesCom and let us worry.

Next the oil markets, let's clear the air !

Why the heck would I want to sell Oil short at these

prices ?

here is only so much oil in the ground and the last

time prices were at these levels historically they gave way to price increases.?

I will continually look to buy break until the sellers sell all they can and can't buy it back down the road.You know the old saying. Buy when the Blood Runs.

Eventually Oil Markets will move higher. However a trader needs to recognize if it is going lower...so stay tuned to FuturesCom for the outlook.

Ditto for the Grains at these prices.

In fact , China is again experiencing floods as it did in 1996 and with Russia broke how do you think next years crops will look like over there ?

Beans, Wheat and Corn have Fifty Cent downside potential and an upside down the road that one cannot put afigure on. We feel the potential is rather attractive these prices , maybe not right now but eventually.

Don't be short.

The Metals... I don't want to short metals at current prices for all the tea in china. They have a ten percent down side risk and an upside that is far greater....

Well I think that this enough for now...traders should stay tuned, vacations are over . I invite you to call my office if you would like more ideas or wish to develop a plan suited to you needs .. In any event stay in touch the rest of this year and into the Year 2000 should be interesting to say the least.

Specific trades will be sent via Special reports, Bi

-Weekly Outlooks, Flashes.

Morning Comments will attend to the next days trading..

So Have Fun and Enjoy!

Happy Trading

Bill

8-13-1998